Local Government Employment Continues Slump for Fifth Consecutive Month: Still Remains 909,000 Jobs Short of Its February Level

Author

Stacy Nakintu

Ricardo Aguilar

Upcoming Events

Related News

|

After four consecutive months of decreases or little change in local government employment, the August jobs report from the U.S. Bureau of Labor Statistics (BLS) showed an increase of only 95,000 local government jobs, continuing a now five-month long period of negative or minimal local government jobs growth. This nominal increase of 0.7 percent leaves local government employment 909,000 jobs short of its February level, and faring worse than state and federal government employment.

Nationally, 1.4 million jobs were added to the economy in August, leaving 13.6 million Americans still unemployed. Though this increase makes August the fourth consecutive month of increased employment, the number of workers who were permanently laid off increased for the fifth month this year, topping 3.4 million, and demonstrating that workers returning from temporary layoffs have been driving the increases in employment since April.

Local Government Employment Remains 909,000 Jobs Short of February Level

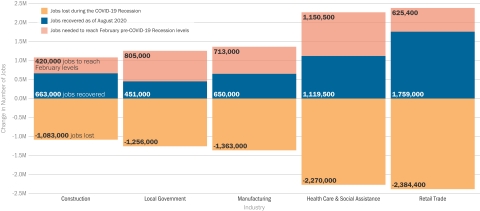

Change in employment by industry, Feb.- Aug.2020

In contrast to the local government sector, the August jobs report suggests other major industries may be moving toward a slow recovery, despite substantial gaps that exist between August and February levels.

- Retail trade added 249,000 jobs in August, yet remained 655,000 jobs lower than February.

- Professional and business services added 197,000 jobs in August, yet remained 1.5 million jobs lower than February.

- Leisure and hospitality added 174,000 jobs in August, yet remained 4.1 million jobs lower than February.

- Education and health services added 147,000 jobs in August, yet remained 1.5 million jobs lower than February.

- Manufacturing added a nominal 29,000 jobs, yet remained 720,000 jobs lower than February.

- Construction added only 16,000 jobs, remaining 425,000 jobs lower than February.

- All other major industries added at least a few jobs, except mining and logging, which continued to decrease by 2,000 jobs and is now 97,000 jobs lower than February.

Non-Education Local Government Employment Still Nearly 450,000 Jobs Below February Level

Change in employment by government sector, Feb.- Aug.2020

Local government employment is, overall, faring worse than state and federal government employment. Education-related jobs in local government increased by 31,700 in August, remaining 462,100 jobs (6 percent) below its February level. Non-education local government jobs increased by 63,300, remaining 447,200 jobs (7 percent) below its February level. State government and federal government jobs have been recovering more quickly than local government jobs, and are closer to their February employment levels. State government employment is only 218,000 (4 percent) below its February level and federal government employment is 296,000 jobs (10 percent) above its February level, driven mostly by a 251,000 increase of federal government jobs (mostly Census workers) in August.

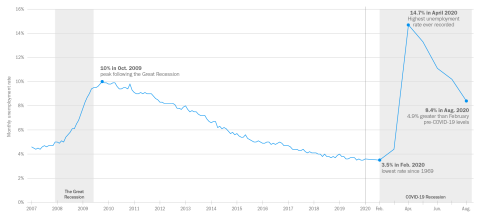

Unemployment Rate Finally Dips Below Peak of Great Recession

U.S. unemployment rate, 2007-2020

Nationally, 1.4 million jobs were added to the economy in August. This leaves 13.6 million Americans still unemployed - 7.8 million more than there were in February. The unemployment rate fell to 8.4 percent – finally falling below the Great Recession high of 10 percent for the first time since March 2020.

Despite many comparisons made between the current COVID-19 recession and the Great Recession of 2007-2008, the two recessions differ considerably in speed, severity and the level of uncertainty, among many other distinctions. During the Great Recession, the unemployment rate took 29 months to rise 5.6 percentage points from its low of 4.4 percent in May 2007 to its high of 10 percent in October 2009. The unemployment rate then took another 89 months to return to this pre-recession low as the effects of the recession lingered. In contrast, the unemployment rate rose 11.2 percentage points in just two months of 2020, from 3.5 percent in February to 14.7 percent in April - 4.7 percentage points higher than the peak of the Great Recession. Further, the unemployment rate has already decreased by 6.3 percentage points to 8.4 percent in the four months since April - a more drastic decrease than the 90 months following the unemployment rate peak of the Recession. On top of these drastic changes in employment, the circumstances of the pandemic further compound the uncertainty of this crisis.

Long-Term Impact of COVID-19 Revealed Through Increases in Permanent Job Losses

Total number of unemployed workers on temporary layoff vs. not on termporary layoff, Mar. - Aug. 2020

Even though there has been a steady increase in employment each month since April, the nation is far from recovering. The BLS reported that the number of workers on temporary layoff decreased by 3.1 million – driving the jobs growth seen in August. On the other hand, the number of workers who permanently lost their jobs increased by 534,000 to 3.4 million – totaling 2.2 million people higher than in February.

In April, unemployment was driven by temporary layoffs, which made up 88 percent of the 20.6 million job losses (by contrast, temporary layoffs comprised only 29 percent of all job losses in February). Since April, the overall number of laid off workers has been steadily decreasing, as has the number of workers on temporary layoff. Permanent job losers, however, have been increasing each month since February (with the exception of July). By August, workers who lost their jobs permanently made up 40 percent of the 10.3 million laid off workers after increasing by 2.2 million since February. Thus, the 10.3 million workers seen returning to work since April are primarily workers ending their periods of temporary layoff. The ever-increasing 2.2 million workers who have been permanently laid off since February represents a more accurate picture of COVID-19’s longer-term economic toll and true job loss.

The BLS recently added supplemental information on the pandemic’s direct impact on the labor force. In August, approximately one quarter (24.3 percent) of workers teleworked at some point in August due to COVID-19. This measure is down slightly from July, when 26.4 percent teleworked. Over 24 million workers in August reported that their employer closed or lost business during the pandemic, not allowing them to work their full number of hours. Finally, over 5 million people were prevented from looking for work due the pandemic, meaning they were not counted as unemployed or part of the labor force (since a person must be actively looking for work to be counted as unemployed).

Overall, the August jobs report reveals a national economy that displays indicators of recovery, but is largely unstable. Over the course of the pandemic, the federal government has invested trillions of dollars to prop up the economy. With funding from the Coronavirus Relief Fund (CRF) distributed and helping recipients temporarily hold together the economy, local governments are in need of additional direct and flexible federal aid to avoid further layoffs and rebuild workforces. Without this funding, essential local government services and workforces may face additional cuts, further weakening the U.S. economy and the nation’s ability to recover.