FY 2024 President's Budget Request

Upcoming Events

Related News

Executive Summary

The nation’s 3,069 counties play a key role in administering federal programs and services in our local communities. Counties own and operate public infrastructure, transportation and economic development assets, provide public safety and emergency response services, and protect the public’s health and well-being. Counties are principally responsible for the delivery of essential local services to our residents, and we rely on a robust intergovernmental partnership to help support our work every day.

This analysis will include summary charts highlighting proposed cuts, eliminations or increases to key federal programs in the president’s budget request for Fiscal Year (FY) 2024 that are relevant to county governments and a section-by-section summary of the budget outlining items of note for county governments.

Proposed Changes to Base Discretionary Funding in Biden's Budget

Source: https://www.washingtonpost.com/us-policy/2023/03/09/biden-budget-taxes-deficit/

Top Highlights for Counties

- Continued funding for critical Bipartisan Infrastructure Law (BIL) programs for highways, highway safety, and transit formula programs. This includes $60.1 billion for the Federal-Aid Highway program, $14 billion to support transit agencies across the country, and investment in environmental permitting programs to expedite delivery of new and modernized infrastructure.

- Increased funding for mental health services, including additional funding for the HHS’ Substance Abuse and Mental Health Services Administration and the 988 crisis line, a $1.3 billion increase in substance abuse prevention and treatment activities, and $387 million towards workforce development in training 18,000 behavioral health providers.

- Dedicated support for the nation’s veterans and military families, including $20.3 billion for the Toxic Exposures Fund (TEF).

- Direct investment in local law enforcement agencies by providing $4.9 billion in discretionary grant funding, including $537 million for the COPS Hiring Program which would represent a $213 million increase over FY 2023 enacted levels.

- Reinstatement of the Child Tax Credit, which resulted in a 50 percent drop in child poverty rates in 2021, the largest decrease ever recorded.

- Direct investments in clean energy and water utility infrastructure projects, including $425 million to support increasing the energy efficiency and the weatherization of the homes of low-income individuals, and $4 billion for upgrading drinking water and wastewater infrastructure with an emphasis on underserved and rural communities.

- Increased investments in local election systems, with $5 billion in mandatory election assistance grants over 10 years to be administered by the U.S. Election Assistance Commission (EAC).

- Expanded support for continued rural broadband deployment funding, via a $400 million in funding for the U.S. Department of Agriculture’s (USDA) ReConnect Program, a county-eligible program which funds telecommunications infrastructure in primarily rural service areas that lack high-speed internet infrastructure.

Federal Budget Process

The President Submits Budget Proposal to Congress

Under current law, the president must submit the budget request between the first Monday in January and the first Monday in February.

House and Senate Budget Committees Develop and Report Budget Resolutions

If the respective chambers pass these resolutions, they reconcile them in a budget conference. This sets the total amount of money congressional Appropriations Committees may spend for the fiscal year. If the two chambers are not able to agree on a budget resolution, each chamber may enact a “deeming resolution,” which sets appropriations levels for that chamber’s Appropriations Committee.

House and Senate Appropriations Committees Allocate Funding to Federal Programs

The Committees set specific discretionary funding levels for federal programs among 12 subcommittees, each dealing with a different part of the budget. After the respective chambers pass individual appropriations bills, they must go to conference to reconcile the appropriations bills for a final vote.

The President Signs Funding Bills into Law

All 12 funding bills must be enacted in time for the beginning of the new fiscal year on October 1st. In recent years, the government has struggled to meet this deadline and instead passed temporary extensions of current spending levels, known as continuing resolutions, well into the new fiscal year.

Overview: The President's FY 2024 Budget Request

Top Line Numbers

Top Line Numbers$6.9 TRILLION $4.2 TRILLION $1.9 TRILLION |

On March 9, President Biden released the FY 2024 budget request outlining the administration’s proposal for budgetary spending for the fiscal year beginning October 1, 2024. The president’s budget requests a total of $6.9 trillion in both mandatory and discretionary federal spending in FY 2024. Federal spending in FY 2024 is not subject to statutory spending caps prescribed by the Budget Control Act of 2011, which has expired as of 2022 and allows lawmakers to decide funding levels for appropriations each year.

With divided control in the 118th Congress, it is anticipated that the Republican majority in the House of Representatives will proposed significant alterations the president’s budget request. Additionally, new rules in the House may dictate the outcome of negotiations the federal budget. This includes the cut-as-you-go rule, which considers out of order any new mandatory spending request that is not offset by revenues raised, and a rule which specifies a stand-alone vote on raising the federal debt ceiling is required as opposed to attaching a raise of the debt ceiling limit to a general appropriations bill.

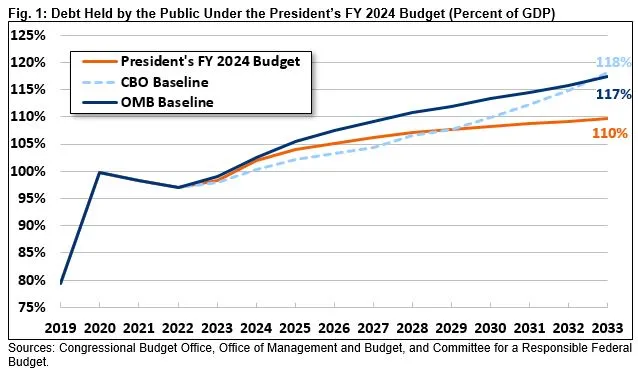

Deficit & Debt

The federal budget deficit is estimated to rise from $1.4 trillion in FY 2022 to $1.8 trillion in 2024. In nominal dollars, the national debt under the president's budget would grow to $43.6 trillion by the end of 2033, which is $3 trillion under the Office of Management and Budget's (OMB) latest baseline projection. The president’s budget includes a significant deficit reduction mechanism that would reduce budget deficits by $3 trillion over ten years when compared against current budgetary trends.

Deficit-reducing items in the president’s budget principally include alterations in the tax code that increase the corporate income tax rate; an adoption of the undertaxed profits rule; providing tax revisions for multinational corporations; imposing minimum income tax on the wealthiest taxpayers; increasing the excise tax on stock buybacks; increasing the top marginal income tax rate for high earners; revising capital income taxation; increasing Medicare taxes for high-income taxpayers; expanding Medicare drug price negotiations; taxing pass-through business income of high-income taxpayers; and other measures.

Congress will need to pass legislation to raise the current debt ceiling limit, as the U.S. reached the debt ceiling limit in January of 2023 and the U.S. Department of Treasury has initiated extraordinary measures since that time to prevent the U.S. from defaulting on payments. The extraordinary measures are projected to only last through June of 2023, by which Congress will need to act.

Major Proposals of Significance to Counties

Continued funding for the Rural Partners Network and other U.S. Department of Agriculture (USDA) Rural Development Initiatives

The president’s budget request included $977.2 million for USDA Rural Development salaries and expenses, a $176.1 million increase from FY 2023 enacted levels, and $32 million to expand the Rural Partners Network, a critical resource to rural communities seeking to take advantage of federal funding opportunities.

Increased water and waste disposal funding

The president’s budget request included a total program level of $2.4 billion for the water and wastewater disposal program, which represents an increase of $323.7 million above the 2023 level. A total of $717.4 million in grant funding would be made available through the water and waste disposal project grants program, which represents a $133.7 million increase above FY 2023.

Renewed investment in crop funding

The president’s budget request revived a lapsed USDA subsidy program which pays out $5 an acre in crop insurance premium subsidies to farmers who planted cover crops in 2021 and 2022. This program was originally funded through COVID-19 relief legislation and was not funded again in FY 2023. The administration’s proposal would make these payment permanent at a 10-year cost of $950 million.

Expanded investment in the Investment Partnerships Program (HOME)

The president’s budget request called for an increase of $300 million to the HOME Investment Partnerships Program (HOME) over the 2023 enacted level. The HOME program allows for the construction and rehabilitation of affordable rental housing and provides crucial homeownership opportunities for county residents.

Launch of the Regional Technology and Innovation Hubs Program

The president’s budget request called for total allotted funding of $4 billion to the Economic Development Authority for the Regional Technology and Innovation Hubs Program that was authorized under the CHIPS and Science Act of 2022. The Regional Technology and Innovation Hubs program would foster the geographic diversity of innovation and create quality jobs in underserved and vulnerable communities across the country while providing counties with significant economic development opportunities.

Advance the Initiative to Reduce Barriers to Affordable Housing and Reform Eviction Policies

The president’s budget request called for a $10 billion in mandatory funding to incentivize State, local, and regional jurisdictions to make progress in removing barriers to affordable housing developments, such as restrictive zoning, as well as $3 billion in mandatory funding for competitive grants to promote and solidify State and local efforts to reform eviction policies by providing access to legal counsel, emergency rental assistance, and other forms of rent relief.

Increased funding for the Housing Choice Voucher Program

The president’s budget request calls for a total of $32.7 billion, which represents an increase of $2.4 billion (including emergency funding) over the 2023 enacted level, for the Housing Choice Voucher Program (HCV) to maintain services for all currently assisted families and to expand assistance to an additional 50,000 households.

Investments in Clean Energy Initiatives

The president’s budget request provided almost $2 billion for clean energy infrastructure projects and the workforce necessary to support these projects. Specifically, the budget would invest $425 million to support increasing the energy efficiency and the weatherization of the homes of low-income individuals; and provide $107 million for the Grid Deployment Office to assist local and state governments, as well as utilities, in bolstering the resiliency of the grid.

Supporting the Economic Transition in Coal Communities:

The president’s budget request would provide $905 million to invest in technologies that can help support the economic transition in energy communities. The budget would also provide further funding for the Interagency Working Group on Coal and Power Plant Communities and Economic Revitalization.

Addressing the Causes and Impacts of Climate Change

The president’s budget request would invest $5 billion to address the causes and impacts of climate change, including by reducing greenhouse gas emissions, increasing resiliency, and working with the international community.

Directed investments in water infrastructure projects

The president’s budget request would invest over $4 billion In water infrastructure, a $1 billion increase over the FY 2023 enacted level. Funding would be directed towards upgrading drinking water and wastewater infrastructure, with an emphasis on underserved and rural communities. Notably, however, the budget would only provide funding for the State Revolving Funds level with the FY 2023 enacted level.

Addressing PFAS Contamination

The president’s budget request would invest nearly $170 million to address PFAS contamination and support the EPA’s PFAS Strategic Roadmap. Specifically, the funding would be directed towards research, remediation and restricting the use of PFAS.

Increased investments in local election systems

The president’s budget request would invest $5 billion for new, mandatory election assistance grants over 10 years. The program, which is to be administered through the U.S. Election Assistance Commission (EAC), would be funded at $1.625 billion in FY 2024 and then $325 million from FYs 2025-2023. Counties traditionally administer elections on the ground and support a consistent stream of federal funding for costs related to overseeing voting systems and polling locations, and maintaining election integrity and security. More on the county role in elections is available here.

Improving healthcare coverage, reducing disparities and enhancing the health workforce:

The president’s budget request would make a 10-year investment of $150 billion for Medicaid home- and community-based services, which wouldalso enhance the home health care workforce and support family caregivers. The budget also proposed to make expanded ACA tax credits from the Inflation Reduction Act permanent, incentivizing non-Medicaid expansion states to continue use of these programs as a means of providing health care coverage for low income adults. Additionally, the budget sought to address health disparities through approximately $471 million for in maternal health care in rural areas and $30 million for rural hospitals. The budget also proposed to invest $106 million in the public health workforce, and build the workforce through the expansion of existing programs such as the National Health Service Corps.

Invested in pandemic preparedness

The president’s budget request would invest $20 billion for HHS’ pandemic prevention and preparedness efforts, which included a $10.5 billion dollar investment in the Administration for Strategic Preparedness and Response (ASPR) to support advance research and the development of vaccines and other medical countermeasures and support the health workforce; a $6.1 billion investment in the Centers for Disease Control and Prevention (CDC) to modernize and build local laboratory capacity and strengthen local public health data systems; and a $2.69 billion investment in the National Institutes of Health (NIH) to continue to conduct research and development of vaccines, diagnostics and therapeutics.

Supported resources for community based mental health and crisis services

The president’s budget request would create a new Rural Health Clinic Behavioral Health Initiative to expand access to mental health services in rural communities, while also supporting key behavioral and mental health funding streams such as the Community Mental Health Block grant with a $645 million funding increase. Additionally, the budget sought to dedicate approximately $836 million in funding from the Substance Abuse and Mental Health Services Administration (SAMHSA) to serve individuals in mental health crisis through the national 988 suicide lifeline, an increase of $334 million over FY 2023 funding levels. The budget would also provide $16.6 billion for mental health services for veterans, which includes suicide research, prevention initiatives and the expansion of the 988 crisis lifeline for veterans.

Bolstered the behavioral health workforce:

The president’s budget request proposed to invest in the behavioral health workforce by providing $2 billion in mandatory funds for the Mental Health System Transformation Fund and $37 million for the Minority Fellowship Programs under SAMHSA, which would aid in workforce development and growing the number of culturally competent behavioral health fellows. Additionally, the budget includes $387 million for the Health Resources and Services Administration (HRSA)’s Behavioral Health Workforce Development Programs, which will be used to train over 18,000 behavioral health providers. The budget also allocates $578 million above the $1 billion authorized in the Bipartisan Safer Communities Act to assist schools in hiring more mental health workers.

Significantly expanded access to affordable child care and free pre-school:

The president’s budget request would invest $600 billion over 10 years for a new federal-state partnership that would increase access to high quality, affordable child care for 16 million young children and free preschool for all four year olds in the setting of their parents’ choice. In addition, the budget proposed a $500 million demonstration program under the Department of Education to create or expand free, high-quality preschool in school or community-based settings in high-poverty school districts.

Cut child poverty in half by expanding the Child Tax Credit

The president’s budget request sought to restore the American Rescue Plan Act (ARPA)’s temporary expansion of the size and eligibility of the Child Tax Credit (CTC). Evidence suggests the proposal to increase the value of the credit ($3,600 per child under 6 and $3,000 per child age 6-17) and allow very low-income households to access this direct income support would reduce child poverty by nearly 50 percent.

Increased housing support for vulnerable foster youth

The president’s budget request proposed $9 billion over 10 years to provide housing vouchers to for the 20,000 youth who age out of the foster care system each year.

Expanded free school meals

The president’s budget request sought $15 billion over 10 years to ensure that 9 million additional low-income children have access to free school meals

Supported free community college

The president’s budget request proposed $500 million for a new discretionary grant program to provide two-years of free community college for students enrolled in high-quality programs that lead to a four-year degree or a good-paying job.

Expanded health care and disability benefits for toxic-exposed Veterans

The president’s budget request sought a $15.3 billion increase in the recently authorized Cost of War Toxic Exposures Fund, which supported the delivery of health and disability benefits to veterans suffering from medical conditions due to toxic exposure during their military service

Bolstered efforts to end Veteran homelessness:

The president’s budget request would invest $13 billion in mandatory funding to expand the Housing Choice Voucher program for 450,000 extremely low-income veteran families by the year 2033

Invested in state and local law enforcement agencies

The president’s budget request would provide $4.9 billion in discretionary grant funding, including $537 million for the COPS Hiring Program which would represent a $213 million increase over FY 2023 enacted levels.

Increased funding for resilience programs

The president’s budget request would provide $3.9 billion for grants from the Federal Emergency Management Agency and other components of the Department of Homeland Security, which would represent a $140 million increase over FY 2023.

Improved immigration enforcement and border security

The president’s budget request would provide $25 billion for U.S. Customs and Border Protection and Immigration and Customs Enforcement, which would represent a $800 million increase over FY 2023 levels.

Funded the Payment In Lieu of Taxes (PILT) program below FY 2023 levels

The president’s budget request would fund the Payment-In-Lieu of Taxes (PILT) program at $535 million, a $45 million decrease compared to FY 2023 levels.

Expanded the Good Neighbor Authority and Steward Contracting Authority to the U.S. Fish and Wildlife Service and the National Park Service

The president’s budget request would expand the Good Neighbor Authority and Stewardship Contracting Authority beyond the Bureau of Land Management and U.S. Forest Service to the U.S. Fish and Wildlife Service and the National Park Service. This would allow these agencies to enter into cooperative agreement or contracts with states, tribes and counties to conduct watershed restoration and forest management projects of federal lands.

Increased funding for wildland fire management

The president’s budget request would provide $1.7 billion for the Wildfire Suppression Operations Reserve Fund, which would represent a $243 million increase over FY 2023 levels.

Increased funding for management of federal lands and resources

The president’s budget request would provide $1.7 billion for the Bureau of Land Management (BLM), which would represent a $140 million increase over FY 2023 levels.

Increased funding for National Forest System land management

The president’s budget request would provide $2.2 billion for land management of the National Forest System, which would represent a $252 million increase over FY 2023 levels.

Increased funding for the State, Private and Tribal Forestry program

The president’s budget request would provide $328 million for the State, Private and Tribal Forestry program, which would represent a $10 million decrease from FY 2023 levels.

Increased funding for the reduction of hazardous fuels

The president’s budget request would provide $323 million for the reduction of hazardous fuels, which would represent a $116 million increase over FY 2023 levels.

Increased funding for the conservation of listed and at-risk species

The president’s budget request would provide $2.1 billion for the U.S. Fish and Wildlife Service, which would represent a $325 million increase over FY 2023 levels.

Provided additional funding for rural broadband

The president’s budget request included a $400 million appropriation for the USDA's ReConnect program, which provides grants and loans to deploy broadband to unserved areas, especially tribal areas. With the funding provided in the Bipartisan Infrastructure Law, USDA has provided nearly $548 million to people living and working across 21 States and Territories to date, which is expected to expand access to 43,189 households.

Expanded the budget for national cybersecurity initiatives

The president’s budget request would provide an additional $145 million for the Cybersecurity and Infrastructure Security Agency (CISA), for a total of $3.1 billion. This included $98 million to implement the Cyber Incident Reporting for Critical Infrastructure Act and $425 million to improve CISA’s internal cybersecurity and analytical capabilities.

Significant investments in transportation infrastructure

The president’s budget request for the U.S. Department of Transportation (USDOT) proposed to invest $70 billion in the nation’s highways, roads and bridges; $40 billion in upgrading and expanding rail and public transit; and $25 billion in airports for an overall net decrease in discretionary spending by just over $807 million from FY 2023.

Offsetting of infrastructure funding would eliminate and replace funding levels for different transportation programs

The president’s budget request would notably eliminate $2.6 billion in “Congressionally directed spending,” better known as earmarks, $800 million in RAISE grants and other funding for competitive components of contract authority programs appropriated in the FY 2023 omnibus, including the Airport Improvement Program, PROTECT Program, and the Urbanized Area Transit Formula Program Buses and Bus Facilities Grants. It would use these eliminations to fund other administrative priorities, including increasing funding for some programs important to counties. Those included the MEGA Grants program, the Thriving Communities technical assistance program, the Grade Crossing Elimination Program, and the Capital Investment Grants program.

County Countdown – Dec. 15, 2025

Every other week, NACo's County Countdown reviews top federal policy advocacy items with an eye towards counties and the intergovernmental partnership.

County Countdown – Dec. 1, 2025

Every other week, NACo's County Countdown reviews top federal policy advocacy items with an eye towards counties and the intergovernmental partnership.

Counties Celebrate Key Permitting Inclusions in SPEED Act

NACo issued the following statement in response to the passage of the Standardizing Permitting and Expediting Economic Development (SPEED) Act (H.R. 4776), which advanced out of the U.S. House Committee on Natural Resources on November 20.