FEMA official: New pricing methodology, ‘Risk Rating 2.0,’ to bring ‘generational change’

Key Takeaways

The Federal Emergency Management Agency (FEMA) is updating its National Flood Insurance Program’s risk rating methodology with a new program dubbed Risk Rating 2.0.

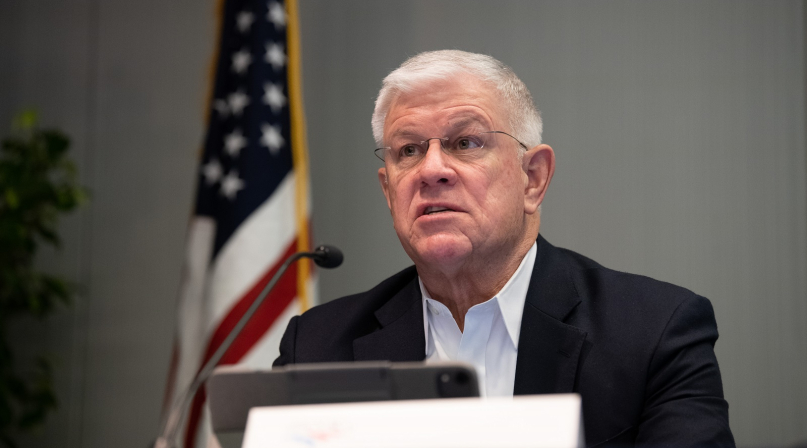

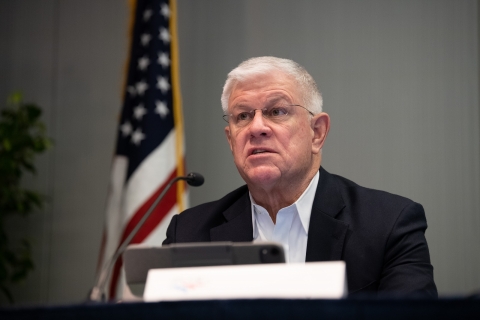

David Maurstad, acting associate administrator for Resilience at FEMA, laid out some of the details of the new program during a discussion Sunday, Feb. 13 with members of NACo’s Gulf States Counties and Parishes Caucus, whose residents have been hard hit over the past few years with hurricanes and more.

While Maurstad described the new program as “fair, equitable and designed to adapt to climate change,” he received some pushback from at least two county officials after the discussion, who said they worry about their constituents’ premiums.

“Please keep in mind that under the current pricing scheme, all policy holders have seen average annual increases of roughly 11 percent over the past number of years,” Maurstad said. “And each and every one of them would have continued to see increases year after year if we had just left things as they are.”

“So let me be clear, the increases in premiums that many are concerned about as we are, would have existed under the old program,” he said.

Under the previous methodology, a single-family home maximum policy cost was more than $45,000; under the Risk Rating 2.0 program, the maximum policy cost is $12,125.

Under Risk Rating 2.0, 1.2 million policyholders will be eligible for an insurance premium decrease and 90 percent will see a decrease or increase of less than $10 a month.

Maurstad also noted that President Biden’s FY22 budget includes a legislative proposal to provide affordability insurance that would support low to moderate income policyholders.

“As we adapt to the effects of climate change, the phrase ‘we are all in this together’ drives our work,” he noted. “I look forward to making your counties more resilient to climate change.”

What is not changing under the new program

- Statutory rate caps on annual premium increases

- Availability of premium discounts

- Transfers of policy discounts to new homeowners

- Use of Flood insurance Rate Maps for mandatory purchase and Floodplain Management

- Availability of premium discounts for Community Rating System participation

Learn more with the following resources:

- Equity in Action Fact Sheet

- Video: Defining a Property’s Unique Flood Risk

- National Rate Analysis

- State profiles

- Zip code level data

Another tool created by the Association of State Floodplain Managers, with Pew Charitable Trusts, is available – an interactive map that shows the impact of the federal flood insurance rate changes. The map tool can be accessed here.

Attachments

Related News

California counties fight agricultural crime

Sheriffs' offices and prosecutors in California's central valley make specific efforts to prevent and prosecute crimes against the agricultural community.

DHS funding set to lapse, putting key county partners at risk of a partial shutdown

The U.S. Department of Homeland Security (DHS) is headed toward a funding lapse at 12:01 a.m. ET on Feb. 14 after the Senate failed this week to advance legislation to fund DHS for the remainder of Fiscal year (FY) 2026.